A new study from Alliance to Advance Patient-Centered Cancer Care program partner, the University of Arizona, dives into financial vulnerability for cancer patients with health insurance, aiming to better understand how health behaviors and psychosocial concerns may be associated with financial burden. Elizabeth Ver Hoeve, MA, from the Department of Psychology at the University of Arizona, is the lead author of the paper, “Patient-Reported Financial Toxicity, Quality of life, and Health Behaviors in Insured US Cancer Survivors,” which was recently published in the journal Supportive Care in Cancer.

At the center of this work is the concept of financial toxicity, defined by the National Cancer Institute as any problem a cancer patient may experience as related to the cost of medical care. Every year, individuals with cancer in the United States spend approximately $4 billion in “direct, out of pocket costs for treatment” (American Cancer Society, 2019). Cancer care expenditures also often include loss of income due to disability, costs of travel and lodging near treatment, and symptom management.

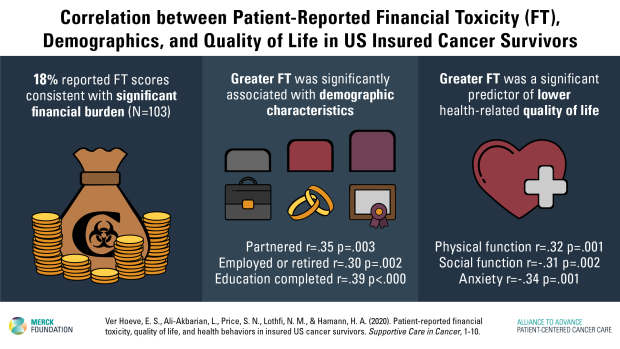

In the face of these worrying data, the team at the University of Arizona set out to investigate whether financial toxicity affects the quality of life and the health behaviors of post-treament cancer survivors. Their study included 103 participants diagnosed with Stage I-III solid tumors (breast, colorectal, head and neck, lung, or prostate) and treated at a NCI-designated comprehensive cancer center. The authors utilized a well-validated patient-report measure of financial toxicity, COmprehensive Score for financial Toxicity (COST). Univariate analyses focused on the demographic and disease-specific factors associated with financial toxicity and utilized the Holm-Bonferroni (H-B) correction to reduce type I errors from multiple comparisons. Multivariate analyses utilized multiple linear regression to understand the degree to which financial toxicity predicted patient-reported quality of life.

Findings revealed that approximately 20% of cancer survivors who agreed to participate faced a “significant financial burden” (Ver Hoeve et al., 2020). Patients who did not have a partner, were not yet retired, and had a lower level of educational attainment experienced greater financial toxicity. As sole income earners, non-partnered cancer patients may have to work throughout treatment and beyond, often without the relief offered by comprehensive sick leave policies. Patients with less education may also work at more physically demanding and lower paying jobs.

The paper found that financial toxicity was a meaningful predictor of patient-reported anxiety, fatigue, physical functioning, and social functioning above and beyond relevant demographic characteristics. This means that cancer survivors’ financial concerns significantly interfered with their quality of life, affecting their moods and psychosocial functioning. Given the impact of financial toxicity on the lives of cancer survivors, the authors suggest that enhanced assessment of patient-reported financial toxicity within survivorship clinic visits may help providers identify patients most in need of comprehensive assistance. Further research should assess the impact of broad health care reform on financial toxicity with the goal of implementing interventions designed to adapt to a changing health care landscape.

Learn more here: Ver Hoeve, E. S., Ali-Akbarian, L., Price, S. N., Lothfi, N. M., & Hamann, H. A. (2020). Patient-reported financial toxicity, quality of life, and health behaviors in insured US cancer survivors. Supportive Care in Cancer, 1-10. https://doi.org/10.1007/s00520-020-05468-z